Beating the street....in vain

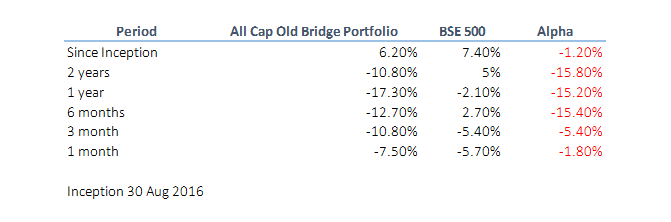

The failure to beat the index is one of the core messages I have seen in the first few letters of Warren Buffett. This is a very difficult thing to do on a consistent basis. Kenneth Andrade is one of the popular fund managers in India. I believe he did a spectacular job managing a mutual fund. I have only heard and not seen the numbers. But I go by what others tell me. Today in multiple groups I received his August 2019 update. And it reaffirms how difficult it is to beat the index. His Old Bridge All Cap fund has as good as a fixed deposit unfortunately. I hope his picks give his investors the alpha they have been looking for. Few years ago I had reached out to the company inquiring whether they could manage my money. Luckily they were not taking more money. Kenneth has a nice point in his letter which goes as A thought does cross the mind – was I really lucky in my journey as a portfolio manager between 2003 - 15. In the last 20 years, I had never to explain and then de