Beating the street....in vain

The failure to beat the index is one of the core messages I have seen in the first few letters of Warren Buffett. This is a very difficult thing to do on a consistent basis.

Kenneth Andrade is one of the popular fund managers in India. I believe he did a spectacular job managing a mutual fund. I have only heard and not seen the numbers. But I go by what others tell me.

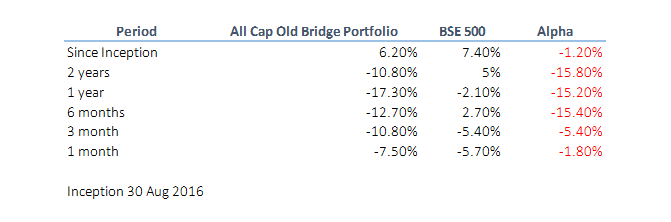

Today in multiple groups I received his August 2019 update. And it reaffirms how difficult it is to beat the index. His Old Bridge All Cap fund has as good as a fixed deposit unfortunately. I hope his picks give his investors the alpha they have been looking for. Few years ago I had reached out to the company inquiring whether they could manage my money. Luckily they were not taking more money.

Kenneth has a nice point in his letter which goes as

A thought does cross the mind – was I really lucky in my journey as a portfolio manager between 2003 - 15. In the last 20 years, I had never to explain and then deal with the level of polarization we have in the markets today. In investing, two years is a short period to judge the same, but the drawdowns in some of the stocks have been sharp enough for us to question our traditional model of investing.

Preservation of capital since late 2017 has been my core focus. As far as I recall even in 2017 most of the fund managers weren't able to beat Nifty50 till 31st December.

Let us see what the future holds. But I am certain Index is not a person to be easily pushed over.

Kenneth Andrade is one of the popular fund managers in India. I believe he did a spectacular job managing a mutual fund. I have only heard and not seen the numbers. But I go by what others tell me.

Today in multiple groups I received his August 2019 update. And it reaffirms how difficult it is to beat the index. His Old Bridge All Cap fund has as good as a fixed deposit unfortunately. I hope his picks give his investors the alpha they have been looking for. Few years ago I had reached out to the company inquiring whether they could manage my money. Luckily they were not taking more money.

Kenneth has a nice point in his letter which goes as

A thought does cross the mind – was I really lucky in my journey as a portfolio manager between 2003 - 15. In the last 20 years, I had never to explain and then deal with the level of polarization we have in the markets today. In investing, two years is a short period to judge the same, but the drawdowns in some of the stocks have been sharp enough for us to question our traditional model of investing.

Preservation of capital since late 2017 has been my core focus. As far as I recall even in 2017 most of the fund managers weren't able to beat Nifty50 till 31st December.

Let us see what the future holds. But I am certain Index is not a person to be easily pushed over.

Comments

Post a Comment