Returns Expectations from Equity Investing

As amateur retail investors one question we usually do not know the answer to is - What is the return we can expect on a very long term time frame from investing?

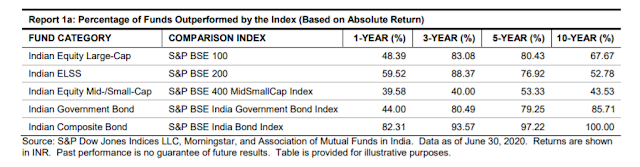

When we meet experts or see claims on twitter of a 30% annualised return how should we benchmark that in our minds. The returns mentioned in this article is based on the CAGR formula. Next time when someone throws at you that his CAGR is 30% then you should quickly be able to know how good that number really is. More importantly this is an article which encourages you to tone down your expectations from Equity Investing. We try to see what returns we can expect from Index investing which is looked at boring and yielding very low returns. Let's see.

Data Details

For this analysis we have taken daily data all the way from 3rd April 1979 of the BSE marquee index the SENSEX. We have data till 4th November 2020. That is 40+ years worth of daily trading data. The argument which usually people give is that 'oh that is too small a time window' does not hold here. We look at every single day from April 1979 to November 3rd 2019. So that we have correct one year annualised rates today on 6th November 2020. If we add in the recent days the CAGR calculations is not truly representative of a year. This is not the TRI index.

Actual Distribution of Drawdown

In these 40 years the index has had a lot of volatility [subjective] and with each movement of the index we can slot it into a bucket of drawdown. Say index was high at 10,000 one day and in another 30 days it was 9,000, then we say there is a drawdown of 10% here. Essentially for calculating drawdown we look at the previous highest value of index and use that to calculate the percentage difference to today's value.

In this analysis we have made 8 drawdown buckets of 0% (no drawdown), 0% to -10%, -10% to -20%, -20% to -30%, -30% to -40%, -40% to -50%, -50% to -60% and lower that -60%. But before we get into that the chart below in blue shows the probability distribution curve of index drawdowns. As we can see the median is roughly -15% drawdown. The -60% range is very rare. I guess that was only in 2008 period.

The thousands of orange dots are the CAGR for every single trading day from 3rd April 1979 to 3rd Nov 2019. The CAGR calculation is from April 1979 to 4th November 2020. So what does this help us in? It gives us a peak into the fact that if we chose any day in these 40 years what would be our CAGR of that investment on 4th November 2020.

There seems a little pattern in the orange dots, doesn't it? Let us look at it statistically.

Average Returns

So now we know each day's CAGR for 40 years. How do we know how this fares. Let us slot the following into each drawdown bucket (as described above):

- Average CAGR

- CAGR with one sigma standard deviation below average CAGR

- Minimum CAGR

- CAGR with six sigma standard deviation below average CAGR

- -60%+ Drawdown: All CAGRs are the highest and close to each other

- As we go from the left to right (in the blue probability curve above) the average CAGR, Minimum CAGR and One Sigma CAGR (along with 6 sigma CAGR) spread out

- Six Sigma CAGRs have never occurred. Rather the worst case scenario has ever been a 2.75 sigma standard deviation from mean CAGR

- Average CAGRs range from 16.32% (0%+ drawdown bucket) to 22.28% (-60%+ CAGR bucket). The red crosses are average CAGRs below.

What to expect?

For answering this we need to know how much time does the index spend in each drawdown frequency. As we can see in the chart below that most of the times we spend time in the 0% to -10% drawdown bucket. As we go into deeper drawdowns the probability of occurrence becomes lower and lower and if you combine this data with the above charts we can say when there is a deep drawdown and you invest you are guaranteed a better return with lesser variance. Return here is CAGR.

The orange line is an example of a 15% CAGR probability line across different drawdown buckets. So it means that on any day if we had invested when the drawdown was -10% or lower (-10% to 0 to more than 0) then we would have a probability of 70% for a 15% CAGR return. As we can see on the 15% CAGR probability line as we go into deeper drawdowns the probability increases all the way from 70% to 80% to 90% and finally 100%. But combining the orange probability line with the blue drawdown probability bars and summing them we get a total 15% CAGR probability as 78.95%.

Thus the probability of getting atleast a 15% CAGR by investing on any day from April 1979 to November 2019 as seen in November 2020 is 78.95%.

Why did I chose 15% CAGR? For Pareto sake. 78.95% is close to 80% that is why. We can have many probability lines below, 25% for instance where the final cumulative probability will drop drastically. 25% is the number experts usually claim. Guess the probability is actually less than 3%! Now we have some visibility into answering how realistic is a 30% CAGR on a 40 year time frame. Probability for 30% CAGR is 0, yes zero! So stock picking of these experts will be really really out of this world. Note this analysis is not for implementing trading strategies but giving us ballpark expectations.

I'd like to express my gratitude for sharing such an excellent article. The article is instructive because it offers some useful information. Thank you for sharing about security bank internet banking. Continue to post.

ReplyDelete