Why we must value a company

Price is what you pay. Value is what you get.

- Profound or cliché?

Treatise after treatise has been written on valuations. Some swear by value investing and some renounce it saying it does not work in India. My personal belief does require me to pay credence to how much I am willing to pay up when I buy a security. In this note I try to capture with a few examples on how to go about calculating in a quick way the intrinsic value of a share. But first a disclaimer. Whatever will follow is just the beginning steps to building a model of your own. Models are for guidance and not prediction. If all models could predict with accuracy all of us would have our own Medallion funds.

What is Price?

Have you ever asked yourself this question? Think about it. Try to break your answer into deeper layers say like in the movie inception. Something like this:

I want to buy Nestle India's stock. It is priced at 17,000 rupees

Does 1 share give me a portion of the net profit to an extent (EPS)

What extent?

No that does not sound right. Earnings is 1/70 th of the current market price

But people are willing to buy and sell at 17K

Why?

Is it demand supply as seen in the order flow?

Does the share price of Nestle have anything to do with the company Nestle?

Does Nestle matter at all?

The market price is the impenetrable truth about a business's future. My conjecture is that the supply demand of a share of a company reflects all future earnings discounted to present and when we try to value the share the intrinsic value differs from that of the market price because we have not considered something which the market has. That is where the difference lies. The mistake is not in the market it is mostly with us.

Usually Mr. Market knows it all but he is very moody. What we investors have to do is take advantage of his mood fluctuations. We need to know when he is absolutely ignorant of one stock and deeply madly in love with another.

At the end of the day everything boils down to how much money is added to the bank roll with the least probability of going bust and valuations serve as an important metric to this objective. It should not be the other way round i.e. to be proven right that one's valuation exercise was correct even if it is not making money.

Leaving all this philosophy aside let us get into execution. I will now have a step by step process to do a back of the envelope calculation of the intrinsic value per share of a company. Please be warned this is a quick and dirty method and not a pristine process from the ivory towers of corporate valuations.

In its simplest form a value of a firm can be given by the simple equation below.

But digging deeper it takes elements of a business across financial statements, market data, like companies and country also. This is how we can see it from an association point of view.

Continuing with Poly Medicure as an example for cost of capital and Kovai Hospitals as a Valuation example. The following sections will be covered

Calculation of:

Weighted Average Cost of Capital

- Cost of Equity: Capital Asset Pricing Model, Beta, Risk Free Rate, Market Returns, Stock Returns, Market Value of Equity

- Cost of Debt: Interest Coverage Ratio, Synthetic rating, Credit Rating, Credit Spreads, Country Rating, Fx Exposure, Pricing a coupon paying bond, Understanding interest bearing credit instruments, Marginal Tax Rate, Corporate Income Tax Laws

Free Cash Flow

- EBIT, Marginal Tax Rate, Fixed Assets, Current Assets & Liabilities, Cash, Return on Invested Capital, Invested Capital, Net Operating Profit Less Adjusted Taxes, Retention Rates, Discounting, Terminal Value

Expectation Analysis

- Sensitivity Analysis, Growth Phases of Companies, EBIDTA growth

Relative Valuations

- Price to Earnings, Price to Book Value, Price to Sales, Price to Cash Flow

I will avoid all theory. There are wonderful resources to read on theory. But most of the theory books don't tell us where to look for data and how to maintain that data. So the intent here is slightly different. Let us jump into it.

In CAPM Cost of equity is equal to risk free rate plus beta multiplied by an equity risk premium. Since in our beta calculation we are using 10 year data we will use 10 year Government of India bond rates. This data is available on the RBI site. Do not worry about the links. I have put all of them in the sheets which I will share at the end of the section. I suggest once you read this you open that sheet and read this again.

For equity risk premium we find the difference between the returns of the market in this cases the SENSEX and the stock over 10 years. This is again built into the Cost of Capital sheet.

Voila we have the Cost of Equity ready!

Now to Cost of Debt. This is a little tricky. Here we are valuing non finance businesses. Also most of the companies we will value won't have their debt being traded. So what we do is that we give it a synthetic rating. Let us do that and make some adjustments.

We calculate interest coverage ratio (which is EBIT divided by interest expense). Simply use the figure freely available on screener website. With this ratio we will look up a table to get a rating and corresponding spread. This table is got from Prof Damodaran's website (if you don't know who he is stop reading. You are not ready for valuing a company yet). He maintains this data point very actively. Now we have a spread over the GOI bond which we had while calculating cost of equity. To this (GOI bond + spread) we add another thing which is the country risk rating. This data is again available readily at Prof's website. So now we have GOI bond + spread + country spread. To this we add the final factor which is called lambda for lack of a better symbol. This takes into consideration the foreign exposure of the company's revenue. This is taken as a ratio of percentage of one minus export revenues to one minus exports as a percentage to the GDP. We multiply this lambda to the country risk rating. So now we finally get the pre tax cost of debt as GOI + spread + lambda * country spread. All this is available with proper links in my cost of capital sheet.

We have our cost of equity and cost of debt ready.

Please get marginal tax rate from the income tax website. A few edge cases will be there. I have incorporated that into the sheet already. Roughly 31.2% is the tax rate at present.

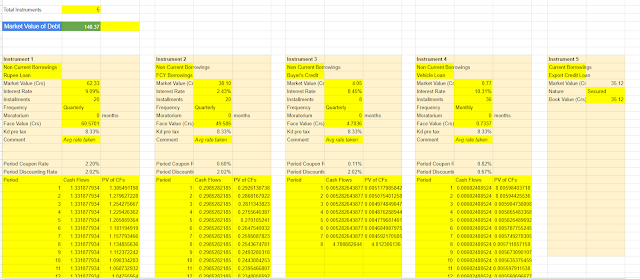

To calculate WACC we need market value of Debt and Equity. Equity market value is very easy as it is the market capitalization. One simple function gives real time data on this in Google Finance. Market value of debt is slightly tricky. This will take 10 mins out of the total 11 minutes to calculate Cost of Capital. You will need to open the latest Balance Sheet and go to the liabilities section. Check the schedule number and go to that schedule. Objective is to look at all the long term borrowings rather all debt which is interest bearing. Now usually companies will state each loan's interest rate, moratorium period, tenure, frequency and face value. Using the pre tax cost of debt treat each loan as a coupon paying bond and calculate the present value of that bond. That simple. For interest bearing debt whose details are not given you have no other choice but to take the book value. Sum up all the market value of debt and you are ready to calculate the Cost of Capital.

WACC = [(D/D+E) * Cost of Debt (1 - T)] + [(E/D+E) * Cost of Equity]

Here is the sheet you can use. Please note that you can create a copy of this sheet and use it for your future references. I have done a sample calculation for Poly Medicure which came to be 13.64%. Looks ok as per the industry it operates in. Let us move on.

Now to the main action. As you update the financials what happens is that the sheet automatically calculates the Free Cash Flows and discounts them using the WACC to its present value. It adjusts for debt and cash and calculates the intrinsic value of a share. Here we think we are done. But not yet. It has been too easy and sort of inaccurate.

Let me go back to what I started with - The Market Price is the all knowing impenetrable truth. The sheet called DCF dashboard has certain sliders. In this example it is a forecast for 10 years with 5 growth years, 5 mature years and then a terminal value. One can play around with that. But the main slider is the growth rate slider. You can adjust that to match the market price to the intrinsic value. What it essentially means is that now the number in the growth cell indicates what the market is pricing in. I have an output as you can see that at the point where market price is equal to the intrinsic price the market is pricing is say a 4% CAGR growth in EBIDTA levels. This is sort of an expectations valuations. Also there is a sensitivity slider for WACC also. A pie chart gives how much each stage of the company is contributing to the value today.

I have left all the fields available to play with. Here is the excel sheet. Again download it and make a copy. Please note you will have to add in components like ESOP valuation, different business segments etc etc. There is no end to it. But in 30 minutes or less you can get an 80%-90% estimate on all key ratios, whether the company is creating value or not and arriving at a ballpark market expectation from that stock.

The intent is not to do a PhD in valuation but to get a sense, a pulse.

I have written this post very hurriedly so excuse me for that. If you want to dive deep I would suggest the following:

WACC

For Cost of Equity we need to calculate Beta first. The best way to do that is regressing the stock price to that of that market. I recommend doing this on Google Sheets using Google Finance. I have made one sheet and made that public for everyone to use. Here it is. But try to understand how that beta is being arrived at. It is essentially the intercept of of the regressed line. I have shown that in the sheet also. We will plug this Beta into the CAPM equation. Also I will share my overall Cost of Capital sheet. This will be built in that too.In CAPM Cost of equity is equal to risk free rate plus beta multiplied by an equity risk premium. Since in our beta calculation we are using 10 year data we will use 10 year Government of India bond rates. This data is available on the RBI site. Do not worry about the links. I have put all of them in the sheets which I will share at the end of the section. I suggest once you read this you open that sheet and read this again.

For equity risk premium we find the difference between the returns of the market in this cases the SENSEX and the stock over 10 years. This is again built into the Cost of Capital sheet.

Voila we have the Cost of Equity ready!

Now to Cost of Debt. This is a little tricky. Here we are valuing non finance businesses. Also most of the companies we will value won't have their debt being traded. So what we do is that we give it a synthetic rating. Let us do that and make some adjustments.

We calculate interest coverage ratio (which is EBIT divided by interest expense). Simply use the figure freely available on screener website. With this ratio we will look up a table to get a rating and corresponding spread. This table is got from Prof Damodaran's website (if you don't know who he is stop reading. You are not ready for valuing a company yet). He maintains this data point very actively. Now we have a spread over the GOI bond which we had while calculating cost of equity. To this (GOI bond + spread) we add another thing which is the country risk rating. This data is again available readily at Prof's website. So now we have GOI bond + spread + country spread. To this we add the final factor which is called lambda for lack of a better symbol. This takes into consideration the foreign exposure of the company's revenue. This is taken as a ratio of percentage of one minus export revenues to one minus exports as a percentage to the GDP. We multiply this lambda to the country risk rating. So now we finally get the pre tax cost of debt as GOI + spread + lambda * country spread. All this is available with proper links in my cost of capital sheet.

We have our cost of equity and cost of debt ready.

Please get marginal tax rate from the income tax website. A few edge cases will be there. I have incorporated that into the sheet already. Roughly 31.2% is the tax rate at present.

To calculate WACC we need market value of Debt and Equity. Equity market value is very easy as it is the market capitalization. One simple function gives real time data on this in Google Finance. Market value of debt is slightly tricky. This will take 10 mins out of the total 11 minutes to calculate Cost of Capital. You will need to open the latest Balance Sheet and go to the liabilities section. Check the schedule number and go to that schedule. Objective is to look at all the long term borrowings rather all debt which is interest bearing. Now usually companies will state each loan's interest rate, moratorium period, tenure, frequency and face value. Using the pre tax cost of debt treat each loan as a coupon paying bond and calculate the present value of that bond. That simple. For interest bearing debt whose details are not given you have no other choice but to take the book value. Sum up all the market value of debt and you are ready to calculate the Cost of Capital.

WACC = [(D/D+E) * Cost of Debt (1 - T)] + [(E/D+E) * Cost of Equity]

Here is the sheet you can use. Please note that you can create a copy of this sheet and use it for your future references. I have done a sample calculation for Poly Medicure which came to be 13.64%. Looks ok as per the industry it operates in. Let us move on.

Valuation Sheet

Now to an Excel sheet which I will give the link to download at the end of this section. This is for Kovai Medical Center & Hospital. As you can see in both Cost of Capital Google Sheet as well as this excel sheet the first page is a checklist. In this valuation excel sheet you will need to update a few things manually as this is not linked to any real time data source. We will paste things like cost of capital, market value of debt, share prices etc. Just follow the summary sheet and you will be good to go. First thing is to get financial data. I get that from screener. You can simply download the excel sheet for the company and paste it into the financial data sheet. As simple as that. Also the excel sheet automatically makes all profitability ratios, relative valuation ratios, solvency, liquidity, cash flow and dividend related ratios available in graphs for trend analysis. I have a small tab to keep the dates updated.Let me go back to what I started with - The Market Price is the all knowing impenetrable truth. The sheet called DCF dashboard has certain sliders. In this example it is a forecast for 10 years with 5 growth years, 5 mature years and then a terminal value. One can play around with that. But the main slider is the growth rate slider. You can adjust that to match the market price to the intrinsic value. What it essentially means is that now the number in the growth cell indicates what the market is pricing in. I have an output as you can see that at the point where market price is equal to the intrinsic price the market is pricing is say a 4% CAGR growth in EBIDTA levels. This is sort of an expectations valuations. Also there is a sensitivity slider for WACC also. A pie chart gives how much each stage of the company is contributing to the value today.

I have left all the fields available to play with. Here is the excel sheet. Again download it and make a copy. Please note you will have to add in components like ESOP valuation, different business segments etc etc. There is no end to it. But in 30 minutes or less you can get an 80%-90% estimate on all key ratios, whether the company is creating value or not and arriving at a ballpark market expectation from that stock.

The intent is not to do a PhD in valuation but to get a sense, a pulse.

I have written this post very hurriedly so excuse me for that. If you want to dive deep I would suggest the following:

- Book: McKinsey of Valuations

- Book: Damodaran on Valuation

- Value Investing by Greenwald

- Papers written by Michael Mauboussin

All the best!

Hi,

ReplyDeleteCan you pls explain in the Nestle stock you mentioned the earnings is 1/70 th of the current market price.how did you calculate this ?

Thanks

Shweta

Hi.

ReplyDeleteI was basically meaning that the PE today is assume 70. Which means that if the company is earning 240 rupees net profit per equity share. For that 240 we are ready to pay 17K to acquire that share.

Rgds

It has been just unfathomably liberal with you to give straightforwardly what precisely numerous people would've promoted for an eBook to wind up making some money for their end, basically given that you could have attempted it in the occasion you needed.

ReplyDeleteContracts App