Poly Medicure: An Overview of the Company

Disclaimer: I am not a registered analyst neither an advisor. These are my notes on a listed company.

Background

This note is only a first order analysis just stating the obvious about the company which is visible to the eye at first glance. Derivative order effects can only be analyzed with deep dive and scuttlebutt. Intent is to have an overview of what the company does and how well is it doing.

Best resource to read is on the VP Forum.

Best resource to read is on the VP Forum.

Poly Medicure Limited is a company which was incorporated in 1995 and today is one of the largest medical devices manufacturer in India. It makes medical consumable products across the following:

- Infusion therapy

- Gastroenterology

- Anaesthesia

- Respiratory

- Dialysis

- Surgery

- Blood Collection Systems & Management

- Renal Care

- Oncology

- Vascular Care

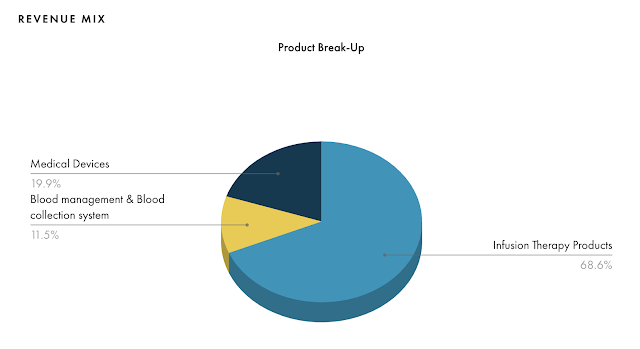

Currently the revenue mix is broken as per the following. Courtesy Tijorifinance.

I do not know the nitty gritties of each product line but I am speaking to my father, an eye surgeon with over 30 years of experience and also my brother in law, an emergency specialist doctor in a developed country. The objective is to understand more about the product portfolio.

The therapeutic break up is as follows.

Anyways coming back to the company. Today it is a 600 Cr revenue generating company with over 3 million units produced daily across its 8 manufacturing plants 5 of which are in India and one each in China, Egypt and most recently in Amaro Italy via the two stepped 100% acquisition of Plan1 Health SRL starting from FY18 to FY19. It is building 2 more plants. One I am aware is coming up again in the Mahindra SEZ in Jaipur as per filings to the exchanges in February 2020. It is primarily an exporter.

Polymed is a 2000 Cr market cap company with 48% shareholding by the promoters. They have no shares pledged. No mutual fund in the country holds any equity in the company. I will try to state year wise how the company has progressed focusing subjectively on the capacity expansion, new product lines, operational efficiencies, inorganic expansions and exports.

Capacity

Today the company produces over 3 million units of its products daily from 8 operational plants (5 in India and 3 outside India). It has 1 R&D center and 2 plants in pipeline. It is estimated that they could increase daily capacity by another half a million by early 2020. Since the acquisition of the Italian company Plan1 Health they have re-branded their upcoming plant in Jaipur under this name. I am assuming its core focus is to take market share in the domestic space and this plant will add to the mission.

If we go back to 2010 the company expanded 20% of its capacity then via a mix of debt and internal accruals. Then again in 2011 it expanded its capacity by another 25% and inaugurated a plant in May 2011. In 2014 it setup the initial plant at Mahindra SEZ in Jaipur and also acquired land in Faridabad for future expansion. All capacity expansion have been via way of debt and internal accruals. In 2015 the Jaipur plant achieved 50% capacity utilization. Additional infrastructure was setup at the Haridwar (pre existing) plant. A new project was targeted at IMT Faridabd in 2017 to broaden segments related to oncology, nephrology and respiratory care segments. This plant started in February 2018.

Product Lines

Polymed has over 125 types of medical devices across the segments mentioned above. It is one of the top 5 global players in the IV Cannula manufacturers. It has over 200 patents which was a humble 80 or so in 2010.

New product additions have been constant over the years. In 2012 they added around 10 new products in the infusion therapy segment. By 2015 they had reached a total of 100 product types in its portfolio. They had 95 product and process patents and had filed for 280 patents in India and worldwide by that year. In late 2016 and onwards they focused to increase their portfolio across the board with a 1 year time frame. They managed to launch 10 more products by the next year. And by the acquisition of the Italian company it again expanded its product suite.

Operational Efficiencies

Polymed is the Indian Medical Device Company of the year in 2019 as per the award by the Government of India. Its R&D facilities are approved by the ministry of science & technology Government of India and all its 125+ products are EU regulatory compliant. Polymed manufactures in 4 countries as outlined earlier. It has a fully integrated system right from product design to manufacturing. I understood that it has automated a lot of its systems and has assembly lines which are fully automatic with vision controls. Its process engineering team of over 30 people manage this. It also has 50+ people in R&D. A lot of the moulding work is done in-house and they have capability of 3 D printing.

The company has had a relentless focus on operational efficiencies right from its early days. It has been optimizing its manufacturing by cost cutting and backward integration from 2009-2010 onwards is what I could make out. The management keeps emphasizing improvement of operations across 10 years in its reports which is quite good to see. In a later section I will highlight how the end result is better than that of a competitor. Even when raw material costs went up in 2011 they were able to cut down on costs because of this economies achieved in operations. In FY12 they focused on waste control measures. In 2015 they focused on rationalizing their sales vertical also. In the last few years they have had technology up-gradation and automation as a key priority. As of 2019 their core focus is on:

- Commercializing new products faster

- Increase foot print in developed countries

- Increase frequency of clinical engagement programs

- Partnerships with medical and research institutions

- Focus on sustainable manufacturing innovation

Inorganic Expansion

Polymed acquired 82% of Plan1 Health S R L via its wholly owned subsidiary based out of Netherlands in FY18. This has given a good foray into oncology and vascular access devices. The deal was closed in FY19 with remaining 18% getting acquired. The new plant which was commissioned in Jaipur in Februray 2020 is named as Plan1 as per filings to the exchanges.

Apart from this it continues to have its JV in Egypt and manufacturing plant in China.

Export and Domestic Market

Polymed has been a very export focused company. As mentioned it has been a leader in exporting medical devices from India for few years. Today 3/4th of revenues are derived from exports. This has been a focus right since the early days. In FY12 Polymed was exporting to 80 odd countries today it does to over 110.

In the recent year there is a focus on increasing the domestic sales. The plant in Jaipur is perhaps oriented towards that also.

Financials

Polymed has been a smallcap with max market capitalization at approximately 2500 Crs. It has a low debt level with a Debt to Equity ration under 0.4 (5 year average 0.39). Interest coverage ratio has increased from 4.5 in FY10 to 8.1. in FY19. It has grown its top line since 2010 FY with a CAGR of over 18% which is a good number and ahead of the industry average as per global estimates. Polymed's operating margins have oscillated but have been fairly good above 20% always.

Debtor days and inventory turnover have been flattish in the last 3 years or so. Current ratio is at 1.8.

From an efficiency point of view it has good ROCE but this has been dropping over the years.

In terms of free cash flow it has always been a positive FCF company in the last 10 years barring FY18 with an FCF of over 68 Crs last year.

From an ROIC perspective there has been a downward decline. That is concerning.

So we have a good growth 18% 10 year CAGR, a 20% ROIC and ROCE company with positive Free Cash Flows. I have not estimated the WACC of the company but from an industry perspective we have a ~12% WACC. So back of the envelope says that the company is creating positive value.

This is the basic overview of the financials. Will need to go through the schedules for the last few years to get a truer and deeper picture.

Valuations

Now this is a subject I try to completely avoid. I will just state the median PE valuations. I have not done a DCF and don't intend to. Pretty sure will have valuation pundits doing so soon.

Export of IV Cannulas

Screener premium provides this data. I hope its not an issue to share the screen shot.

Competition

From a competitor perspective in India I do not think there is any listed entity. What came to my mind is to search for the creator of DispoVan syringes. One of the old companies (estd 1959) though not listed is Hindustan Syringes & Medical Devices based out of Faridabad. They are the owners of the famous DispoVan brand. Product lines of HSMD & Polymed overlap. I have not done a like to like comparison. Looked at the financials of HSMD to get an understanding of the revenue and margins. In FY19 Polymed just overtook HSMD in terms of total revenue terms.

The margins for Polymed are much better and I am assuming this will have some fundamental reasons such as different product lines etc. Polymed has a very extensive product suite in my opinion. HSMD has cannula, infusion sets, syringes, hypodermic needle, scalpels, blood collection equipment & saftey boxes. I came to know via the VP forum of some of the reasons. But from the 10 year annual reports the relentless pursuit of operational efficiency is clearly visible.

HSMD has 128 Crs of debt as of FY19.

Other competitors include Romsons based out of Agra. I am yet to study their statements.

From an international perspective the German company Braun (B Braun Melsungen AG) is perhaps the world leader in this space. Germany seems to be quite ahead in this industry. Followed by companies from China, as expected. Mindray is the Chinese company which is the most prominent. Other competitions include:

- Fresenius Kabi AG

- Baxter

- CareFusion Corporation

- Hospira

- AccuVein

- Vuetek Scientific

- VienView Flex

- IV-Eye

- Veinlite

- Aetna

- Evena

- Carecentrix

- Axela Care

- Tricare

I have not dived deep into each one.

Clearly as per my assumptions Polymed is the leader in India.

Growth Prospects

Now this is where the whole investment thesis should boil down to. And this is something which is quite open ended in my mind. I do agree that there is a fundamental tailwind in the healthcare space. Given the leading position Polymed occupies it should be very difficult for it to mess up the lead it has. So far the management seems to have done a good job in growing. The core question is 'Why should it increase operating revenues at a disproportionate rate with same or better efficiency?' I need to study and formulate an opinion on this. So no conclusions yet.

Disclosure: I may or may not have an investment in the company. This is not an advice.

Sources: Thanks to Screener, Tijori Finance and RBSA advisors.

Sources: Thanks to Screener, Tijori Finance and RBSA advisors.

I really like it whenever people come together and share thoughts. Great post, keep it up. Herbal Juices In India

ReplyDelete