A Few Thoughts on Market 'Correction' during COVID-19 as we move into FY 2021

It has been a max drawdown of approximately 40% from the peak in January 2020 to the last few days of March 2020. The speed has been the fastest they say since 1929 for such a decline in the global markets. It took the Nifty 50 to go down 40% in 45 trading days. To put things into context the Nifty 50 fell 65% in 10 months in 2008. The speed this time has been brutal.

So be it.

I can't control how the market moves but I can control what percentage of equity I hold and what is allocated to cash & safe debt. I can control what decisions I take to invest. Do I have to get swayed to put money into businesses which are mediocre or worst because some seasoned investor put in during bullish times? No. I have to stick by my rules. My rules are very simple. At a high level the following:

My core stocks must be businesses which if I forgot my demat survives 20-30-more years. Survival is the key in this core holding. I also like to have heavy bets on businesses which are doing well in employing capital, growing well and having respectable returns on equity. The core businesses should be generating free cash flow and should be very light on debt (exception for lending businesses where I pay a lot of emphasis on return of capital they lend out). Sometimes rarely I will make an exception.

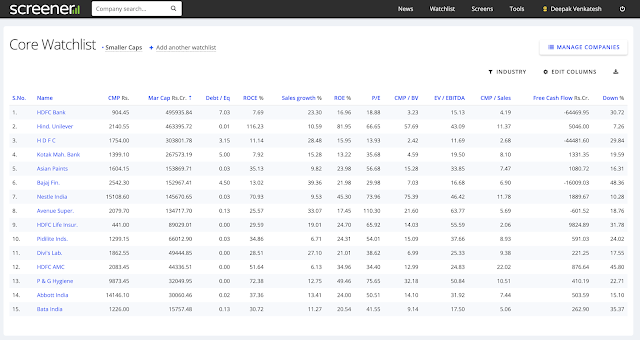

Currently my core holdings not in any order are mostly from the watchlist below. The core portfolio is almost 70% or more of my equity portfolio.

Apart from these core stocks I have a long list of smaller cap stocks. Here I might be playing some theme via a basket or expecting sales growth, improvement in margins and/or re ratings. I hold many small businesses in this section but a few which I am tracking with interest include the list below.

Coming back to overall market correction or perhaps the start of a recession via this bear market. I still feel the market is only fairly valued. Yes there will be some stocks whose price would have been decimated and some would be relatively well off. I would continue with my deployment strategy till the market falls off to reach the first quartile of historical valuation levels. Else I will hold my cash to my chest. I am ok to make less in a bull market but I want to save my portfolio in the bear markets.

It is very odd to be fully invested in equities in a raging bull market and then call yourself a 'value investor'. I do not call myself a value investor. I noticed many seasoned investor with years and decades of experience having huge equity exposure at 99th percentile level of index valuations. It does not make any sense to me. One has to withdraw chips from the table basis some allocation strategy.

The next few months and in my amateur understanding 2 to 3 years we will see the true impact of COVID-19 on businesses world over. It is too early to call out the precise events which would unfold owing to the virus's impact. No one knows much. I excuse myself from making predictions but I am prepared for a long haul of drawdown and sitting on the sidelines.

I hope I have the confidence, patience and compose to survive in the markets. Because that is the key.

So be it.

I can't control how the market moves but I can control what percentage of equity I hold and what is allocated to cash & safe debt. I can control what decisions I take to invest. Do I have to get swayed to put money into businesses which are mediocre or worst because some seasoned investor put in during bullish times? No. I have to stick by my rules. My rules are very simple. At a high level the following:

My core stocks must be businesses which if I forgot my demat survives 20-30-more years. Survival is the key in this core holding. I also like to have heavy bets on businesses which are doing well in employing capital, growing well and having respectable returns on equity. The core businesses should be generating free cash flow and should be very light on debt (exception for lending businesses where I pay a lot of emphasis on return of capital they lend out). Sometimes rarely I will make an exception.

Currently my core holdings not in any order are mostly from the watchlist below. The core portfolio is almost 70% or more of my equity portfolio.

Apart from these core stocks I have a long list of smaller cap stocks. Here I might be playing some theme via a basket or expecting sales growth, improvement in margins and/or re ratings. I hold many small businesses in this section but a few which I am tracking with interest include the list below.

Coming back to overall market correction or perhaps the start of a recession via this bear market. I still feel the market is only fairly valued. Yes there will be some stocks whose price would have been decimated and some would be relatively well off. I would continue with my deployment strategy till the market falls off to reach the first quartile of historical valuation levels. Else I will hold my cash to my chest. I am ok to make less in a bull market but I want to save my portfolio in the bear markets.

It is very odd to be fully invested in equities in a raging bull market and then call yourself a 'value investor'. I do not call myself a value investor. I noticed many seasoned investor with years and decades of experience having huge equity exposure at 99th percentile level of index valuations. It does not make any sense to me. One has to withdraw chips from the table basis some allocation strategy.

The next few months and in my amateur understanding 2 to 3 years we will see the true impact of COVID-19 on businesses world over. It is too early to call out the precise events which would unfold owing to the virus's impact. No one knows much. I excuse myself from making predictions but I am prepared for a long haul of drawdown and sitting on the sidelines.

I hope I have the confidence, patience and compose to survive in the markets. Because that is the key.

Yeah... Holding in bad times is the key. Rest all exercise, in no matter what sensible way it is, will give respectable profits.

ReplyDeleteYou are going way too defensive in selection of stocks, this might not come without a price.

I understand your views. Thanks.

ReplyDeleteOne question, I see BF in your holdings. You still holding it? Sorry, for the blunt question, Just a retail investor trying to swim through the markets. I too have this stock in the portfolio, intend to hold it for long-term, though, bought it at around 3700 odd. I do expect the pain for NBFCs to continue for the next two quarter and the stock may slide to 1500 too. It would be great, if you can share your views?

ReplyDelete